Impact-linked compensation: How to move from kids’ shoes to a grown-up model

Success in the venture capital world has long been rewarded with a share of profits called ‘carried interest’. In the impact investing market, fund managers are trialling ‘impact carry’ with an aim of proving their commitment to impact. Fund managers and investors discussed the pros and cons of this young model at a recent event.

A revolution that the European Investment Fund (EIF) kick-started in 2018 has increasingly become the gold standard for European impact funds: impact-linked compensation, also dubbed “impact carry”. Just like its older uncle “carried interest” (a share of financial profits for fund managers), who has been a regular in venture capital for ages, this relatively new kid on the block also ties fund managers’ compensation to a pre-defined target. The distinctive novelty: it’s an impact target – and this is where the problems start.

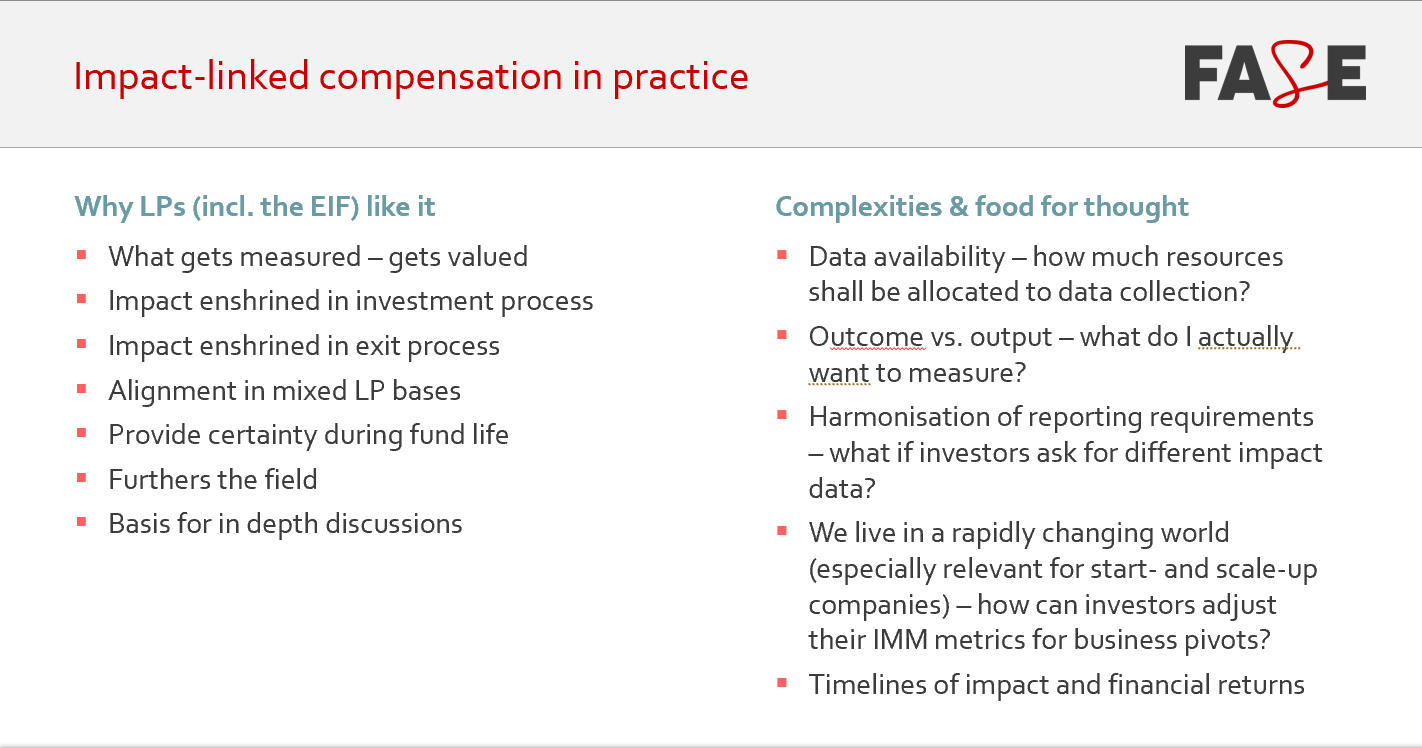

In FASE’s More Impact for Lunch event, held online this month, practitioners from both sides, GPs [the fund managers] and LPs [the fund investors], passionately discussed the beauties and pitfalls of this far-reaching model. The way it works is similar to the classic venture capital carry: A fund defines an impact target – such as a certain amount of CO2 removal – on which each portfolio company needs to report. The managers then aggregate these numbers on fund level and report them back to their LPs. If the targets are met, managers receive their carry, but only if the fund’s financial return target (known as a hurdle) has also been achieved. As a result, there’s a double burden for the fund: the additional impact reporting plus the extra risk of reaching both carry triggers. No wonder having an impact carry has become one sign of a fund’s true impact commitment.

Growing pains of a young model

Yet at this early stage of impact-linked compensation practice, dealing with an extra complexity seems to be the name of the game. Roughly 150 out of around 1,000 impact funds in Europe have adopted the model to date. “The carry model as it currently stands is a remnant of the times of whalers and the East India Companies, so changing this model is hundreds of years overdue,” summarised Diederik Wokke (pictured), chief conscious investments at the Wire Group. Wearing the double hat of GP and LP due to the Wire Group’s fund-of-funds, he pointed out that the entire industry needs to collaborate to create a more grown-up model. “The LP-GP relationship spans several years. If we have the courage to say that we don’t know exactly how things will work but share the same goal and collaborate, then we can make impact carry the new normal.”

Yet at this early stage of impact-linked compensation practice, dealing with an extra complexity seems to be the name of the game. Roughly 150 out of around 1,000 impact funds in Europe have adopted the model to date. “The carry model as it currently stands is a remnant of the times of whalers and the East India Companies, so changing this model is hundreds of years overdue,” summarised Diederik Wokke (pictured), chief conscious investments at the Wire Group. Wearing the double hat of GP and LP due to the Wire Group’s fund-of-funds, he pointed out that the entire industry needs to collaborate to create a more grown-up model. “The LP-GP relationship spans several years. If we have the courage to say that we don’t know exactly how things will work but share the same goal and collaborate, then we can make impact carry the new normal.”

Comparability of impact data is a huge issue...attribution is very difficult to prove. This is why we need to simplify the current model

Additional complexities come from the type of investees. “We target 100 investments in very early and pre-seed stages, and we do not take board seats. At this stage, standard VC models would expect 10-15% of companies to achieve an exit. This highlights the importance of the founders’ commitment to impact. It also raises the question of why and when to report on impact. Impact carry, by definition, only happens if there’s an exit,” explained Alex Bakir, general partner of Norrsken Accelerator. Another complexity was brought up by Lara Viada (pictured), partner at Creas. This Spanish impact pioneer has used the impact carry model developed by the EIF since its second fund which was raised in 2018: “In my eyes, comparability of impact data is a huge issue, especially once we’re looking at more complex social impacts. On top, attribution is very difficult to prove. This is why we need to simplify the current model,” she said.

Additional complexities come from the type of investees. “We target 100 investments in very early and pre-seed stages, and we do not take board seats. At this stage, standard VC models would expect 10-15% of companies to achieve an exit. This highlights the importance of the founders’ commitment to impact. It also raises the question of why and when to report on impact. Impact carry, by definition, only happens if there’s an exit,” explained Alex Bakir, general partner of Norrsken Accelerator. Another complexity was brought up by Lara Viada (pictured), partner at Creas. This Spanish impact pioneer has used the impact carry model developed by the EIF since its second fund which was raised in 2018: “In my eyes, comparability of impact data is a huge issue, especially once we’re looking at more complex social impacts. On top, attribution is very difficult to prove. This is why we need to simplify the current model,” she said.

The lack of comparability can also lead to strange situations. “I’ve seen several funds that have invested in the same company but report on different metrics for this exact same investee,” shared Bakir (pictured). “This can’t be efficient. We really need to standardise.” Multiple metrics from investors also put a strain on the companies. Founders often speak about heavy impact measurement and management (IMM) burdens, especially when their companies are still in very early stages. “As a seed investor, we only focus on a convincing Theory of Change and one impact metric that is strongly linked to impact growth,” Bakir explained. “This way, the model works for us and the company, and also helps the founders with future investors in later stages.”

The lack of comparability can also lead to strange situations. “I’ve seen several funds that have invested in the same company but report on different metrics for this exact same investee,” shared Bakir (pictured). “This can’t be efficient. We really need to standardise.” Multiple metrics from investors also put a strain on the companies. Founders often speak about heavy impact measurement and management (IMM) burdens, especially when their companies are still in very early stages. “As a seed investor, we only focus on a convincing Theory of Change and one impact metric that is strongly linked to impact growth,” Bakir explained. “This way, the model works for us and the company, and also helps the founders with future investors in later stages.”

Intentionality scrutinised

Despite all the challenges, the practitioners agreed that impact carry is a great tool to embed mission alignment into a fund’s DNA and, as Kelley Luyken (pictured), in charge of impact and research at Aurum Impact pointed out, “align decision-making with impact intentions”. For Aurum Impact, part of the Goldbeck family office, impact carry is an important sign of how much intentionality the team of an investee fund has. However, it’s just one out of many puzzle pieces that make up the full picture of a fund’s impact alignment, she is convinced. Wokke shared the same sentiment: “It is vital that there is full alignment along the entire chain, from the investee companies, to the fund managers, to the LPs.” Impact incentives also help greatly to align a fund’s team, as Viada has experienced in the funds managed by Creas.

Despite all the challenges, the practitioners agreed that impact carry is a great tool to embed mission alignment into a fund’s DNA and, as Kelley Luyken (pictured), in charge of impact and research at Aurum Impact pointed out, “align decision-making with impact intentions”. For Aurum Impact, part of the Goldbeck family office, impact carry is an important sign of how much intentionality the team of an investee fund has. However, it’s just one out of many puzzle pieces that make up the full picture of a fund’s impact alignment, she is convinced. Wokke shared the same sentiment: “It is vital that there is full alignment along the entire chain, from the investee companies, to the fund managers, to the LPs.” Impact incentives also help greatly to align a fund’s team, as Viada has experienced in the funds managed by Creas.

The lively discussion with more than 80 impact carry aficionados in the session was too short to dive into all the fascinating and challenging aspects of impact-linked compensation. In the end, Wokke hit the nail on the head when he raised the question of investor additionality: “Does our money really make a difference, or could the project be financed by the BlackRocks of this world?” This is where impact carry has an important role to play and needs to step into bigger shoes.

The crux: impact-linked compensation is complex, builds on intentionality, and needs standardisation, simplification and collaboration to mature. For those who would like to dive deeper into the topic, the Impact-Linked Compensation Project is a great source to investigate the state of play.

Christina Moehrle is a freelance communications advisor working with FASE among others. This feature was produced in partnership with FASE.

Thanks for reading our stories. As an entrepreneur or investor yourself, you'll know that producing quality work doesn't come free. We rely on our subscribers to sustain our journalism – so if you think it's worth having an independent, specialist media platform that covers social enterprise stories, please consider subscribing. You'll also be buying social: Pioneers Post is a social enterprise itself, reinvesting all our profits into helping you do good business, better.