Opinion: Emerging and diverse fund managers outperform – here are five reasons why

Investing in an emerging manager means taking a bet on someone with less obvious ‘track record’. That's no reason to stay away: on the contrary, there may be good reasons to invest – not least because a first- or second-time fund manager is likely also from an underrepresented background. Alina Klarner of Impact Shakers examines the evidence.

If you were looking to invest in a female-managed fund in 2021, you had a 90% chance of it being an emerging manager, i.e. partners managing their first or second fund, likely <US$100m. Let’s take a minute to let that sink in: 90% of all female fund managers are considered emerging at this point.

If you were looking to invest in a female-managed fund in 2021, you had a 90% chance of it being an emerging manager, i.e. partners managing their first or second fund, likely <US$100m. Let’s take a minute to let that sink in: 90% of all female fund managers are considered emerging at this point.

With only 1.4% of US-based financial assets managed by diverse-owned firms, it is no far stretch to say that the same is likely true for other underrepresented groups of fund managers.

Investing in an emerging manager means taking a bet on someone who has less direct track record of managing a venture capital fund and who is likely tapping into a new market niche. However, it also means accessing a part of the VC market that has a higher potential to outperform. Just as with diverse founders, the data proves that emerging fund managers outperform and that diverse fund managers outperform.

- Explore our series on social investment and diversity: Rebalancing the Books

For example, Pitchbook’s Q1 2021 Benchmarks showed that 27% of first-time funds generate top quartile returns compared with 20% of non-emerging funds. And VC firms that hired 10% more women partners had on average 9.7% more profitable exits and 1.5% higher annual returns, according to HBR research on “The other diversity dividend”.

It is clear then that we need to invest in more emerging, diverse fund managers. If the numbers are not enough to convince you, here are five reasons why diverse and emerging managers outperform.

1. Emerging fund managers have been building dealflow for a long time

Very few people wake up one morning and decide to raise a fund. Most emerging managers have spent years as an employee or partner in another fund, as an angel investor or in the wider startup ecosystem, e.g. in an accelerator or startup studio. This means that, while they might not have run a fund before, they have spent years building dealflow and strong relationships, and helping startups succeed, often as hands-on operators.

Just as with diverse founders, the data proves that emerging fund managers outperform and that diverse fund managers outperform

In addition, any emerging fund manager has to show their ‘track record’ – in other words, that they are able to successfully find, invest in and manage a portfolio of startups from scouting to exit. Most emerging managers therefore spend a significant amount of time upfront to build an angel portfolio or set up smaller syndicates or microfunds to show a ‘preview’ of what their fund will look like. This requires – you guessed it – building strong dealflow to be able to prove out your thesis. It also requires investing in the very best startups you can access, but without being able to invest significant amounts yet – a perfect starting point to deploy a first fund at speed!

|

Two underrepresented, first-time managers who successfully raised their first funds:

|

2. Emerging and diverse fund managers do more with less

Emerging managers are out to prove themselves. Every emerging manager is well aware that their first few investments with a new fund will set the tone; they need to be uncompromising in selecting the very best deals. They will work harder and put in place lean management structures and fund teams. Especially for diverse emerging fund managers, running a lean ship and working to beat the odds will be nothing new – most of them have spent years proving themselves with limited outside support and beating the odds in life and in business.

- Read: Beyond entrepreneurial capital: why some female founders are choosing to be ‘under-represented’

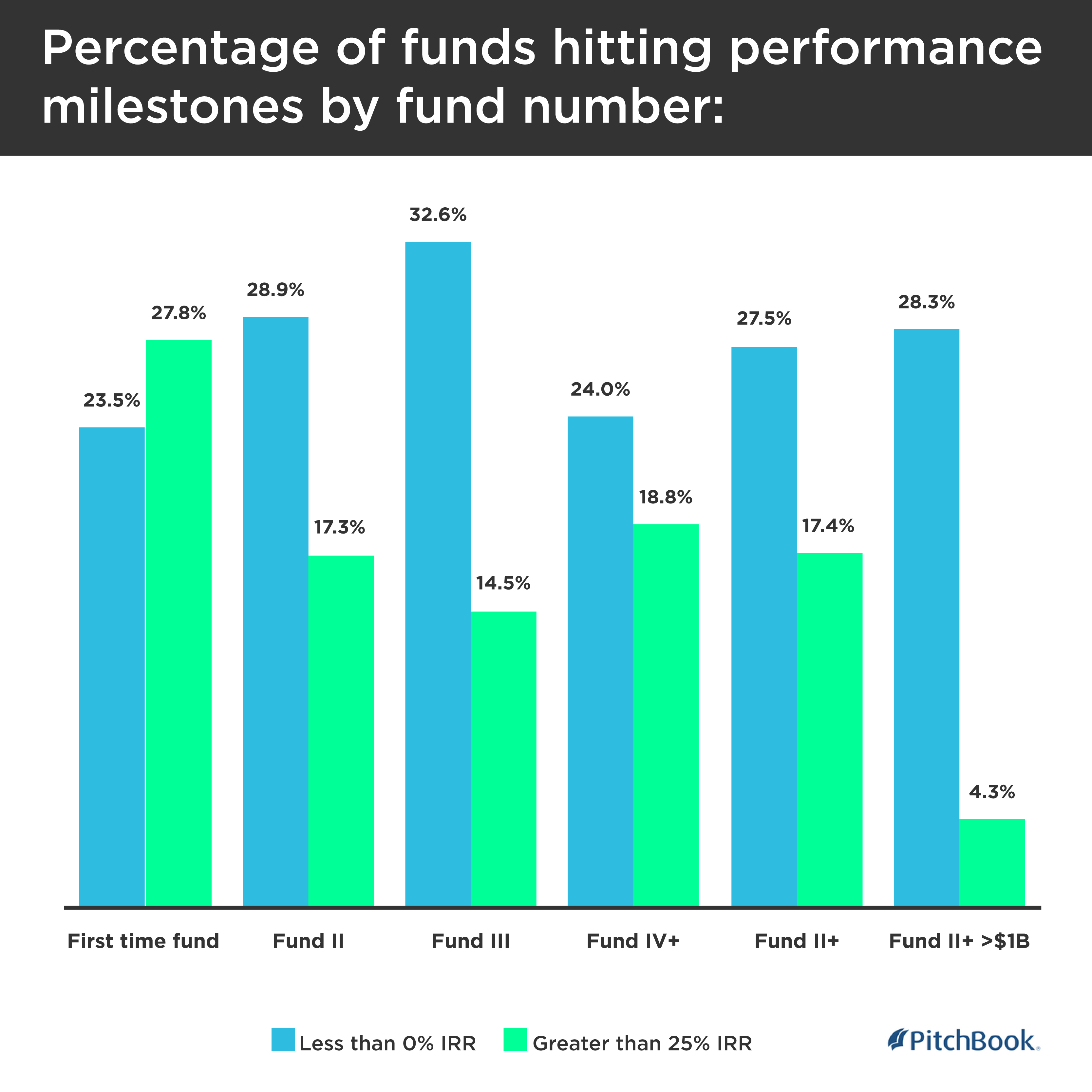

Don’t believe this makes a difference when it comes to generating returns? According to Pitchbook data on first-time and emerging VC funds published in 2021 (see graph), first-time fund managers not only have a higher chance of outperforming against more established peers, they also have a lower chance of underperforming.

Finally, lean management structures and generally smaller tickets also mean that first-time funds can move faster and be more agile in closing the best deals. Plus, in a downturn scenario like the one we are currently facing, first-time funds don’t have to contend with challenged legacy portfolios and can learn from other people’s mistakes to avoid investing at inflated valuations or in unsustainable business models. This means they can deploy their capital to invest in promising new companies at more conservative valuations and with sound business models, rather than having to reserve and inject additional cash into struggling existing portfolio companies.

3. The best founders want investors who understand them and are aligned with their mission

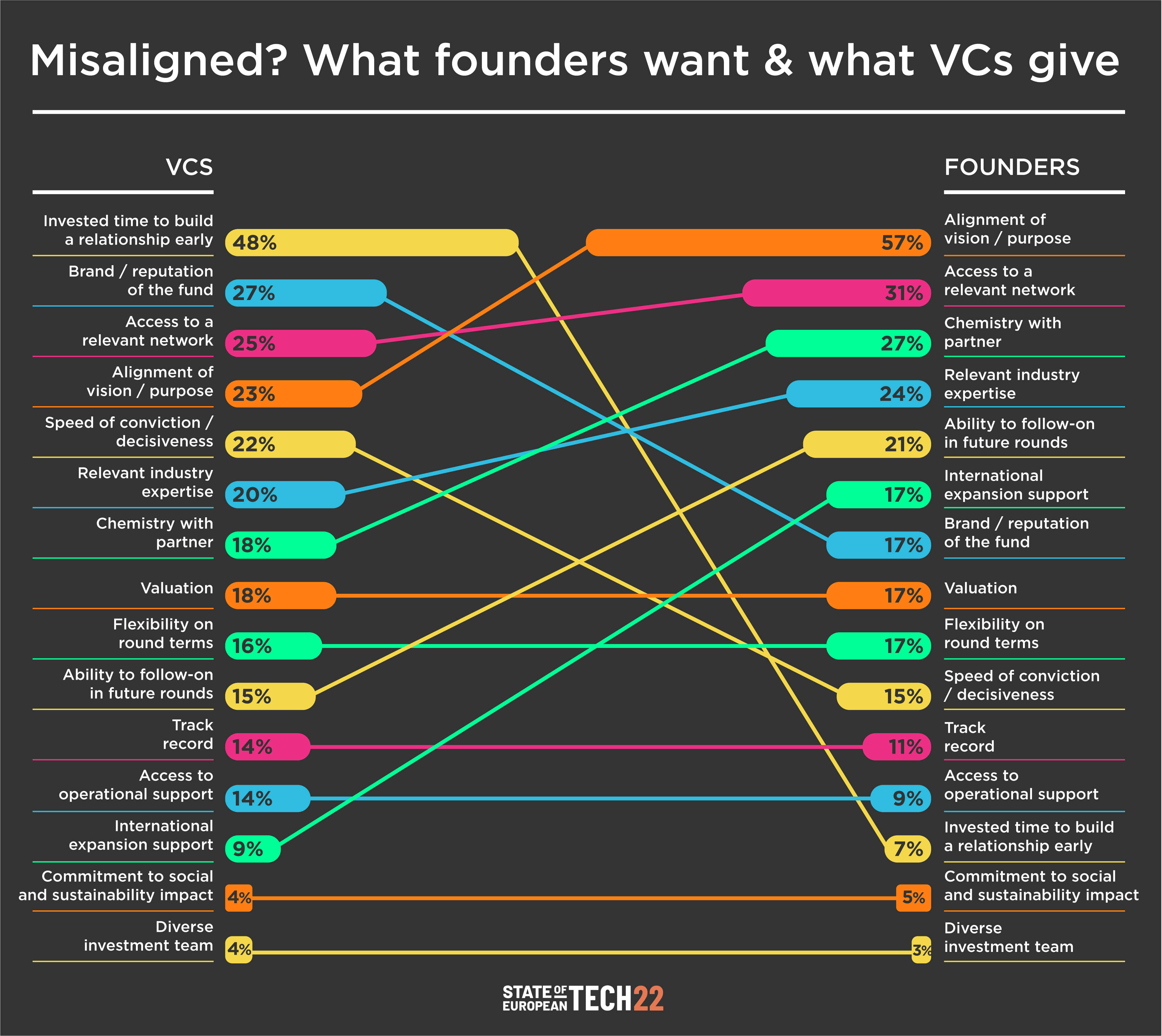

Founders are increasingly educated on the fundraising process; they want capital, access to network and expertise, but mainly, they want investors that are mission-aligned and understand and support the vision of their business. The 2022 State of European Tech report found that entrepreneurs see alignment of vision and purpose as the number one factor in choosing their investors, and chemistry as the third most important factor (see graph).

For diverse and impact founders alike, this means looking for diverse investors who understand the explicit and implicit barriers and can help their founders overcome them. So if LPs want to tap into the overlooked opportunities presented by diverse and impact businesses, they need to invest in diverse, emerging GPs.

4. They have access to and understand diverse innovators

Above: Impact Shakers focuses on diverse impact founders from across Europe – the team reviewed over 2,000 startup pitches in 2022

If founders are looking for vision alignment, it works the other way around too. Ask any diverse fund manager and they will tell you that they are not struggling to find exceptional diverse founders. To name just two of many – we at Impact Shakers focus on diverse impact founders from across Europe, and we reviewed over 2,000 pitches from startups in 2022. Meanwhile Cornerstone VC, a UK-based fund focused on diverse founders, receives around 150-200 inbound pitches per week.

Ask any diverse fund manager... they are not struggling to find exceptional diverse founders

Instead, diverse fund managers will explain that they are able to tap into overlooked communities to find talent and innovation that is out of reach for others – because these are the communities they have a deep connection to and because they have innovated the way they generate and evaluate dealflow, leaving behind some of the traditional biases and roadblocks.

5. They become fund managers to make a difference in VC

Emerging fund managers often decide to start their own funds because they see a gap in the market, an underserved industry or investment approach that has the potential to outperform. With diverse fund managers, this creates a win-win situation because they can tap into overlooked markets with enormous returns potential (think the rise of femtech or silvertech), as well as providing access to capital to historically underserved entrepreneurs.

In addition, diversifying the investor base brings diversity of thought and experience and that, as we stated above, means better returns for everyone.

What’s not to love?

|

Ready to start investing in diverse emerging managers? A good place to start is to get in touch with organisations that provide both education and access to diverse emerging fund manager talent. Some examples are: Some tips:

|

- Alina Klarner is head of ventures at Impact Shakers. This feature is produced in partnership with Impact Shakers.

Photos: Women entrepreneurs pictured at Soshe festival in Brussels (credit @ismavisuals); Impact Shakers

Disclaimer: While we try to make sure that all Pioneers Post content is accurate and up-to-date, our content is provided for your general information purposes only and does not constitute financial, legal or technical advice or any other type of advice, and should not be relied on for any purposes.

Thanks for reading Pioneers Post. As an entrepreneur or investor yourself, you'll know that producing quality work doesn't come free. We rely on our subscribers to sustain our journalism – so if you think it's worth having an independent, specialist media platform that covers social enterprise stories, please consider subscribing. You'll also be buying social: Pioneers Post is a social enterprise itself, reinvesting all our profits into helping you do good business, better.